Engagement & Retention project | JioStar

JioStar is India’s newly formed media powerhouse, established in November 2024 through the merger of Viacom18 and Disney Star (formerly Star India), as a result of an $8.5 billion joint venture between Reliance Industries, Viacom18, and Disney India

About the Company:

JioHotstar, owned by JioStar India Private Limited (formerly Star India), is one of India’s premier OTT platforms. It provides access to a rich collection of over 100,000 hours of TV shows and movies across ten languages, and broadcasts major global sporting events

Exclusive & Popular Content

- Extensive Catalog

Includes top-rated Indian TV series, regional films, Bollywood blockbusters, and international favorites sourced from global studios - Original Programming

Invests in acclaimed originals like Special Ops, Aarya, and The Night Manager, designed to resonate with Indian audiences - Premium Sports Coverage

Offers live sporting action in ultra-HD with features such as real-time analytics and multi-angle viewing. Events include IPL, ICC cricket, the Premier League, Wimbledon, and more

Core Value Proposition

JioStar combines premium content, massive distribution, deep regional access, sports dominance

Differentiators from competitors

a. Regional + Global Content

- Combines Star India's TV dominance (Star Plus, Star Gold, regional channels

- Disney’s global IP (Marvel, Pixar, Star Wars, Hotstar Specials) with Reliance’s access to mass-market Bollywood, sports, and originals.

b. Pan-India & Global Reach

- Regional channels, multilingual OTT, and metro audiences.

- Ability to license and localize global IP, and distribute Indian IP globally.

c. Jio + Hotstar bundling

- Leverages Jio’s telecom subscriber base for OTT push.

- Pre-installed OTT and affordable data packs

d. IPL Rights Consolidation

- JioCinema holds digital IPL rights; Star has TV rights

- Enables cross-device campaigns for sponsors

e. Subscription and Freemium Optimization

- Premium content behind paywall (Hotstar, Disney+), mass content freemium

f. Tech-Led Personalization

- Personalization, ad targeting, and recommendations.

- Leverages cross-device login data across TV, mobile, and fiber.

The new Home page of JioHotstar

Understanding Natural frequency

User Type | Definition & Behavior | Natural Frequency of Usage | Goal Type | Goal Priority (Primary/Secondary) | JTBD (Job-To-Be-Done) | Triggers | Price Sensitivity (Premium User or Free user |

|---|---|---|---|---|---|---|---|

Casual User | User who prefers watching occasional sports matches. he/she onlt | 1-3 times a month | ✅ Personal ✅ Social ✅ Financial | Primary: Access to favorite sports teams live and watch sports with family members Secondary: Free access to content | -Find easy access to favorite sports and movies |

| Free user. (Watches Ads d) |

Core User | User prefers watching movies, shows after work, college | 1-2 times a week (every weekend) | ✅ Functional ✅ Financial | Primary: Access to large and high quality content library Secondary: Tiered-based subscription saving money | Access to favoritee shows and movies and personalized - Minimize costs of owning DVD and cancellation available anytime. Free access to some of the content in case of subscription cancellation |

| Super Subscription Moderate Core users in small town - |

Power User | Heavy user, relies on OTT platform for their entertainment. Binge watches shows | 5-7 times a week | ✅ Functional ✅ Personal ✅ Social | Primary: Access to high quality content and entertainment Secondary: 4 people can access one account. |

|

| Premium Subscriber |

Which engagement model works best for JioHotstar?

Depth: Unlike productivity or learning apps, spending more time in one sitting doesn’t always translate to better platform value. A user watching for 3 hours on one day and coming back 6 days later is less valuable than someone who checks in 4 days for 2 hours

Primary

Breadth ✅: The more genres, content formats (TV shows, Hotstar Specials, Sports, Movies), and features a user engages with, the more value they derive from the platform. It builds habit, expands their content discovery, and increases chances of retention

Secondary

Frequency ✅: More sessions per week help strengthen habits. If a user returns every evening to watch a sitcom, their perceived value of the platform increases. Frequent logins also improve personalization, recommendation accuracy, and upsell potential

build your ICP's- by now you know how to do that in a tabular format as done in earlier projects and segment the users, think about why you are segmenting and what is the goal of your product and segmentation

ICP and Customer Segmentation

This segment is drawn to JioHotstar primarily for its sports content, especially live cricket. Typically younger and working professionals, they are casual users who value convenience, multi-device access, and highlights/replays. However, they are deterred by excessive ads and may hesitate to upgrade to premium unless incentivized with exclusive sports perks.

2. Family Person

Usually older and married, this segment watches content alongside their family and values ease of use across devices. They prefer light-hearted genres, news, and shows suitable for all age groups. They are often already premium subscribers, indicating a higher willingness to pay for ad-free, family-friendly content. Their feedback reflects a need for better content curation and simpler discovery.

3. Weekend Binge Watcher

This ICP comprises young professionals who treat OTT as a weekend escape. Their behavior shows a mix of action, comedy, and fiction consumption, with usage peaking during weekends or off-hours. They are aware of features like offline downloads and multi-device access but may be selective about upgrading unless the value is obvious.

4. The Real Binge Watcher

The most digitally engaged ICP, this segment comprises young individuals (often students or early-career professionals) who binge-watch frequently and deeply. They're highly influenced by trending content and value discovery but are often turned off by too many ads and prefer to explore on their own rather than depend on recommendations.

5. Movie Enthusiast & Pop Culture Nerd

This is a culturally savvy, urban audience segment that actively seeks quality content - both Indian and international. They are often married, professionally well-placed, and open to spending on premium experiences. What keeps them hooked are smart features like “because you watched…” and access to niche titles. However, they expect high content quality and are vocal when disappointed.

Customer Segmentation

| Usage | Criteria | Characteristics |

Casual | 1-3 times a month

| They are either students or early professionals. Movies and shows might not excite them. They might watch 1-2 movies based on reviews |

Core | 2-4 times a week Super user or premium subscriber - Tier 1 Free user - price-sensitive tier 2 user Movie and show enthusiast | They are either early to mid professionals living in tier-1 or tier 2 cities. Since JioHotstar targets a larger base from tier 2 with access to TV channels. They might tune in to their favourite shows during weekends |

Power | 4-5 times a week or everyday user. Most likely a premium subscriber. Some might opt for free subscription with ads (Price sensitive tier 2 city residents) | Power users are mostly likely subscribers in Tier1 cities. They might tune in to their sitcoms after a hectic day at work. Tier 2 and Tier 3 - They might watch a lot of TV channels on Hotstar |

Goal based segmentation

- The Relax & Unwind Viewer

This user opens JioHotstar primarily to relax after a long day or unwind over the weekend. They gravitate towards light-hearted content such as romcoms, comedies, or episodes that don’t require emotional investment. Their engagement peaks in the evening or on weekends, and they respond well to personalized recommendations, continue watching.

Engagement drivers: Recommendations - The Informed Watcher

Motivated by a desire to stay updated, this user consumes live news, trending reality shows, or major sports events like IPL. They frequently log in during live broadcasts and prefer content that helps them stay socially and culturally aware. Timely notifications and live alerts are key to keeping them engaged

Engagement drivers: Latest updates, email push notifications - The Explorer

They tend to binge-watch dramas, thrillers, or long-form originals and enjoy discovering new characters and plotlines. They are highly engaged when served with recommendations tailored to their preferred genres or emotional themes.

Engagement drivers: Genre top picks (In app segments) - FOMO-Driven

Heavily influenced by what’s trending on social media, this user watches content quickly to stay part of the cultural conversation and avoid spoilers. They are typically younger, active on platforms like Instagram and X (Twitter), and expect JioHotstar to surface the latest shows as soon as they drop.

Engagement drivers: Social media notifications, trending content - Shared Family Viewer

This segment consists of users who primarily watch content with their family, often spanning multiple age groups. They prioritize ease of use, simple navigation, and content that’s appropriate for everyone, such as family dramas, news, kids’ cartoons, and mythological shows

Engagement drivers: Multiple devices, profiles, Curated content for kids - Kill Time

For this user, JioHotstar serves as a way to pass time while commuting, taking breaks, or multitasking. They rewatch episodes of familiar shows, or browse casually without deep engagement. They value quick access.

Engagement drivers: Continue Watching, push notifications

Answer the list of questions in the project guide to determine your hook. This is not a compulsory section; you can opt for it or always revisit it later.

Write down or mention at least 5 engagement campaigns to drive engagement.

Engagement Strategies

Let's jump into engagement campaigns!!!

Campaign 1

Casual to Core

Segment | Casual users who watch high quality content (ICP5) |

User behaviour | These are free or low-frequency users who show a preference for iconic, high-production franchises like Marvel, Star Wars, etc., but are not fully engaged or subscribed yet |

Why this campaign would work? | Leverages nostalgia, fandom pride, and completion bias. Complete the quest feels like an adventure and keeps the user hooked |

Problem addressed | Reignite their interest through gamified engagement, exclusive unlocks, and emotional pull of franchises (FOMO + Fan Loyalty) |

Goal | Increase engagement across iconic franchises (Marvel, Star Wars) |

Pitch and content | Watch Unlock. Only true Marvel fan completes the quest. Reignite the thrill and get exciting offers |

Channel | Email push notifications |

Current Frequency of the user | 1-4 times a month |

Timing | Every Saturday morning or Thursday evening |

Success Metric | % watchlist completed No of free users turned into subscribers % of Franchise Watchlist Completed Repeat App Sessions/Week Click to watch rate on email/push notification |

Offer | 50% off on 1st month of the subscription |

Core to Power | Campaign 2 |

Segment | Core user |

User description | Active users who engage regularly, but tend to stay within a limited set of genres (e.g., only watching drama or comedy). They are loyal but haven’t explored the full content universe yet |

Why this campaign would work? | Builds habitual behavior using themed nudges and makes content exploration effortless |

Problem addressed | Discovery fatigue and genre limitations -users don’t explore beyond what they already like, limiting their value |

Goal | Increase engagement across genres (Succession, House of Dragon, Industry, HIMYM) |

Pitch and content | Gamify discovery. Did you know? 5 different genres are trending on Hotstar this week Monday Blues - Light rom-com Tuesday Night - Drama Night WTF Wednesdays - Get some thrill and chill! Throwback Thursday - Kid, I know you're not going out and looking for a life partner. Let Ted remind you how chaotic your love life could be! |

Channel | Email push notifications |

Current Frequency of the user | 2-3 times a week |

Timing | 4 times a week |

Success Metric | % watchlist completed No of super users turned into premium subscribers New Genres viewed per user Session frequency per week |

Offer | Free upgrade for the next payment cycle Watch party invitation. |

Core to Power | Campaign 3 |

Segment | Non-metro Core User |

User description | These are consistent users from Tier 2/3 cities or rural regions who primarily consume TV content, including daily soaps, regional news |

Why this campaign would work? | Regional news and daily soaps are trusted formats in non-metro markets |

Problem addressed | OTT experience is limited to catch-up or live TV, and often lacks personalization. Tap into familiarity to build deeper session time and increase DAU |

Goal | Increase engagement across TV channels/ TV dramas Increase average session duration |

Pitch and content | From evening soaps to late-night headlines, your daily stories unfold here. Log in daily for your dose of drama and desh ki baat! Use language personalization (Hindi, Tamil, Bengali, etc.) based on user profile |

Channel | Email push notifications, Updates on Live trending news |

Current Frequency of the user | 2-4 times a week |

Timing | 3 times a week, Ideal triggers: 6:30 PM - 9:30 PM (prime time) |

Success Metric | Average Watch Time (per user/week No. of user increased from non-metros Prime time watch time MAU and DAU |

Offer | Discount on Jio offers |

Campaign 4

Core Users with drop in engagement

Segment | Core Users who were previously very active |

User description | Previously active for at least 4 weeks |

Why this campaign would work? | Taps into nostalgia and unfinished journeys |

Problem addressed | Prevents engagement metrics dropping. Many left a series or movie mid-way. By offering a “resume where you left off” experience, the campaign plays into completion bias and emotional recall. |

Goal | Win back users by reactivating sessions and converting them through emotional re-engagement |

Pitch and content | Remember the drama you left halfway? Or that thriller you never finished? |

Channel | Email, SMS, Whatsapp Links lead users directly to where they left off (1-tap resume |

Current Frequency of the user | once a week. Previously 2-3 times a week |

Timing | 2 times a week, preferably Friday and Sunday (8pm-10pm) |

Success Metric | % of returning users who resume where they left off Session Frequency Post-Reactivation |

Offer | Resume watching the show you left incomplete and unlock the deal (30% off in the next cycle) |

Campaign 5

Fast Forward Friyayyy!! - Converts busy professionals to Core Users

Segment | Casual users |

User description | Users who log in only 1–2 times/week, mostly on weekends or during late nights. Often fall behind on series, trending shows, or live events. Session time is usually lower |

Why this campaign would work? | Consider their timings and start recommending mini series in the beginning before the success metric picks up |

Problem addressed | Users lack time during the week, which leads to disengagement or decision fatigue on weekends |

Goal | Reduce the content overwhelm for casual and time-constrained users by offering a "curated catch-up" experience, driving weekend session starts and mini series discoveries |

Pitch and content | Survived another crazy week? Same. Who needs a 9 season series when the craziness is wrapped in 1! Click on the link and unlock like a boss |

Channel | Email, Whatsapp notification |

Current Frequency of the user | once a week |

Timing | Thursday Friday and Sunday 8pm-10pm |

Success Metric | Session time per week/per user Click to watch rate |

Offer | Ad free experience for 30 days id they're non premium users |

Figure out the retention data for your product. If you don't have access to the same, begin by adjusting the industry standards. Plot down the data and bring to life your retention curve. Draw out observations and insights from the same.

What is causing your users to churn?

Go back to your user insights and figure out the number one reason of churn by listing down all the factors.

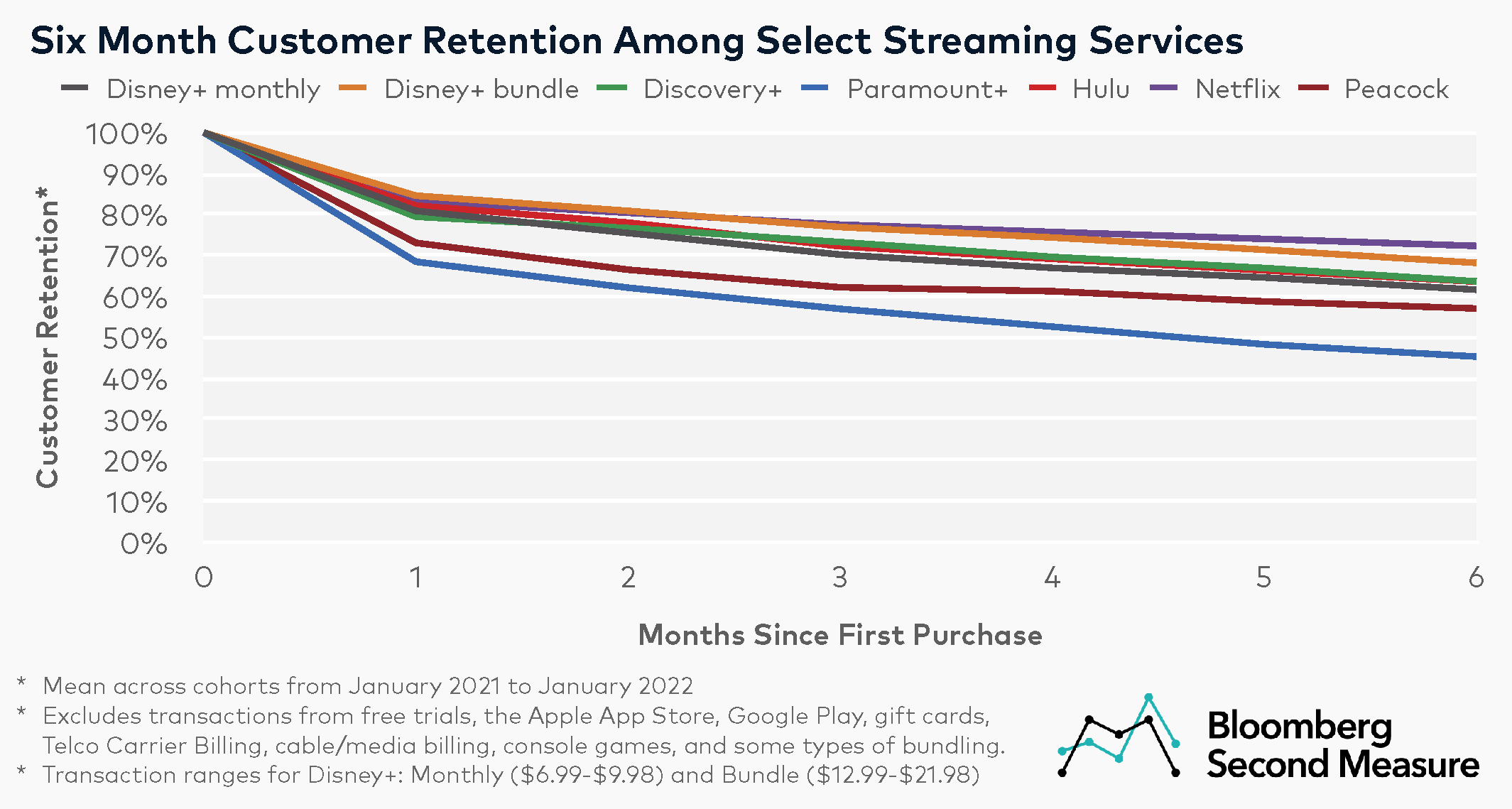

Retention Graph: Flattening at approximately 68%

Approximate Retention Curve

| App / Retention (days) | D1 | D7 | D28 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 |

|---|---|---|---|---|---|---|---|---|

JioHotstar | 85% | 80% | 78% | 75% | 75% | 70% | 68% | 68% |

Netflix | 78% | 78% | 78% | 72% | 70% | 70% | 66% | 66% |

Amazon Prime | 75% | 72% | 72% | 68% | 66% | 65% | 62% | 60% |

Actual Retention graph in the industry

Industry retention graph flattens around 60% - 65% . Among all the OTT platforms, Netflix has the highest retention. Assuming JioCinema + Disney+ Hotstar merger, we can assume that the latest retention must have improved (combining users of both the platforms)

JioHotstar retention and viewership might fluctuate during IPL

Broad reasons for Churn:

- Multiple free plans available

- Content library can feel overwhelming due to variety of content

- Seasonal content (IPL)

Reasons for Churn

Voluntary Reasons

- Content fatigue from the content library and not being able to decide what genre/movie to watch after a hectic day. Many users might see drama content more often - These users browse heavily but struggle to find fresh, relevant content

ICP and User segment affected: Weekend Binge watchers; Core User/Power User

Channel to drive retention: In-app recos: “Your Weekend Picks”; Push on Sat morning with new content, Email push notification - Moviegoers and nerds might get access to a lot of spoilers before even watching the content

User segment: Core User

ICP: Movie enthusiast and pop culture nerd

Channels to drive retention: Social media sync alerts: “Watch before it trends” - Cricket enthusiasts may drop off post IPL season - These users typically join the platform during high-stakes sporting events like the IPL or ICC tournaments, primarily for free access to live matches. However, their engagement is seasonal and short-lived, driven by event-based excitement rather than sustained platform value

User segment: Casual User

ICP: Cricket Enthusiast

Channel to drive retention: Email push notification about alternate options - Ads interrupting multiple times even for a 20 min episode

User segment - Casual/ Core tier 2 users

ICP: All

Channel: Nudges to upgrade to premium via Email - Abundance of other OTT platforms with high quality content and easy discovery. JioHotstar requires a quite a bit of digging to discover highly rated content

ICP: All (mainly movie enthusiasts and pop culture nerds)

User segment: Core and Power users

Channel: Social media and Email push notification about the highly rated content - Attempt to reduce screen time

User segment and ICP: All

Channel: Email notification updates about short documentaries, mini series etc

Which ICP is most likely to churn?

Cricket Enthusiasts post IPL: They are seasonal binge watchers

Most likely reasons of churn: Casual User due to ad interruption

Involuntary Reasons

- Subscriptions auto-cancelled due to financial downturns.

ICP and user segment: All (Tier 2 users but it could be anyone)

Channel: Promote ad-supported premium content (no subscription required) - Might not check email push notifications

ICP: Family person

Channel: Whatsapp Nudges "We miss you" - Family priorities and getting busy with work

ICP: Family person, Cricket enthusiasts or weekend binge watchers getting tired and choosing other alternatives

Channel: Whatsapp/Email notifications - Addicted to short-form content leading to a short attention span

ICP: Weekend binge watchers, Real binge watchers

Channel: Email, Social media nudges mini series, short form content (Mini documentaries, series etc) - User might relocate to a region with poor Jio network/connectivity issues

ICP: Tier 2/3 users or 1 users relocating; could be any ICP

Channel: Email push notifications about latest plan (low data mode etc)

Which ICP drives the retention?

ICP which drives maximum retention:

Family person, Weekend binger watcher and Real binge watcher drives maximum retention

Core and Power Users likely to drive maximum retention

Reasons:

- OTT nerds: Likely to use the platform frequently (daily/weekly), forming viewing habits, a key retention factor

- Content: Values original and exclusive shows, indicating loyalty to specific content types.

- Price Sensitivity: Willing to pay for uninterrupted access (premium tiers)

- Engagement Depth: Tends to explore multiple genres, enabling better personalization (watchlists, recommendations).

- More Likely to Churn only if: Content quality drops or another platform wins exclusive IPs

User Insights

ICP | Frequency | Content affinity | Price Sensitivity |

Binge watchers : Weekend and Real binge watchers | Real binge watchers tend to engage with the platform daily or multiple times a week, especially during free time or while multitasking. Many users describe streaming as part of their night-time routine, suggesting a habit loop | These users actively seek out new shows and are particularly drawn to exclusive IPs, originals, and fresh drops. Their FOMO around trending content keeps them engaged | Binge watchers are often less price-sensitive and more willing to subscribe for ad-free or early access to content. Their priority is uninterrupted viewing over saving on subscription fees |

Family person | The Family Person segment includes users who watch content with their spouse, children, or parents. Their engagement is driven by shared experiences, not just individual entertainment | This ICP values content that is family-safe, dubbed in local languages | This segment responds well to bundled offers, such as Jio plans |

Which acquisition channels drive retention?

- Direct - Frequent direct visits indicate that JioHotstar has become a habit or a part of daily life. This habitual use indicates stickiness which drives retention. These users often return without being prompted, making direct traffic a critical signal of organic retention. The stronger this channel, the less reliant the platform is on constant re-engagement efforts, leading to sustainable long-term loyalty

- Socials - Drives FOMO and converts active scrollers to viewers. Memes, trailers, behind-the-scenes clips, or match highlights often prompts users to re-engage with the platform. Social content works on emotional and cultural triggers - whether it's FOMO for a trending show, peer recommendations, or live engagement during a major event. While social traffic may not always convert into immediate logins, it plays a vital role in reactivating dormant users and maintaining a presence in the user's media ecosystem. This helps drive episodic and campaign-based retention

- Email (Push notification) - Personalized nudges like “New episode out” or “Match starts in 15 mins.” This drives episodic retention. Email and push notifications are essential for delivering personalized reminders and content updates at the right time. These channels work best for driving retention among users who may not habitually open the app but are still interested in the content

What features drive retention?

- Freemium Access

Free, ad-supported premium content reduces entry barriers and keeps users engaged. - Regional & Multi-Language Content

Wide language variety builds emotional and cultural connect, enhancing stickiness. - Personalized Recommendations

Smart suggestions and “continue watching” rows reduce decision fatigue and drive repeat usage.

What are the negative actions to look out for churn?

Negative actions | Implications | Churn probability |

No engagement with Email alerts | User is intentionally opting out of engagement prompts. They don’t want to be reminded, nudged, or disturbed - often a signal of disengagement or overload. | Medium-High |

Usage dropping | Consistent decline in session duration reflects waning interest, either due to content fatigue, better alternatives, or lack of relevance | High |

No redirection post email push notifications | User opens emails but doesn’t engage with the app afterwards. This may mean the CTA isn’t compelling, or they’re passively consuming info without intent to act. The retention strategy needs fine-tuning. | Medium-High |

Auto pay cancelled | Proactive opt-out is a direct churn indicator. Requires urgent win-back effort | High |

No Engagement With Trending Content | User is disconnected with the trending content | Medium |

You have already created the engagement campaigns, resurrection campaigns are quite similar just keep in mind the churned users that are being targeted here.

(customized your campaigns as per the ICP you're targeting to bring back, add parameters accordingly)

Campaign 1

Cricket Enthu signing off post IPL

Segment | ICP1 - Post IPL drop-off |

Goal | Bring them back with sports-adjacent content and other live tournaments (Football) |

Why would this campaign work ? | Keeps them updated about other genres they can watch. Genres that will give them the same amount of adrenaline |

Pain point | User considers JioHotstar as a sports streaming platform |

Content/Pitch | Miss the rush? Miss the energy? Your next tournament is here! Only on JioHotstar Why wait for the next tournament when Euphoria is keeping you energized (promote sport adjacent or thriller shows) |

Offer | Free activation of super subscription for 1 month only if the user gets back on the platform within 14 days |

Frequency | 2 times a week |

Timing | Trigger notification if the user has not engaged post IPL |

Personalize according to the tournament season. If there is a live tournament, send them a reminder a day before it starts Non-tournament season - Sport adjacent genre recommendation through email notification 'We haven't seen you in a while" | |

Success Metric |

|

Campaign 2

2. Family person annoyed with the clutter

Segment | ICP2 - Users dealing with content fatigue |

Goal | To bring them back on the platform with more personalized recommendations (based on history, genre) |

Why would this campaign work ? | This campaign will be used to remind them of the "ME TIME BINGE". Makes the user feel seen beyond just the gatekeeper of animated kid's content |

Pain point |

|

Content/Pitch | Your me time needs a makeover! This show gives us just that! Watch and don't forget to subscribe |

Offer | Upgrade on the previous plan if the user subscribes( Super to premium on the same amount) |

Frequency | 3 times a week |

Timing | Trigger notification if the user has not engaged or reactivated plan for the month |

Personalize according to the user browsing history and genre picks Tuesday for the Plot! - Watch the unfiltered drama with the Kardashians. Wednesday for the Family! - You think your family is chaotic enough. Here's the twist! Even Californian family got no chill | |

Success Metric |

|

Campaign 3

The Nerd! No one can match my taste in pop culture kind of nerd

Segment | Content dilemma. Have nothing to wear ? No. They end up watching nothing! |

Goal | To recommend critically acclaimed shows |

Why would this campaign work ? | Appeals to their taste with smart recommendations |

Pain point |

|

Content/Pitch | Your time has come! Welcome to the game where the money talks! Watch "The dark money game" |

Offer | Reactivation plan - 50% off for the next 2 months |

Frequency | 2 times a week |

Timing | Trigger notifications if the user has not engaged for more than a month and has not reactivated their plan |

Personalize according to the user genre picks Tuesday for the Thrill! - Watch groundbreaking shows, one you have not heard of, only on Hotstar Friday for the Fun! - You think you're too cool? There's a political sitcom waiting for you. Politics + Comedy - Sounds familiar right? | |

Success Metric |

|

Campaign 4

Desi Indie Fan

Segment | Tier 2 users feeling tired of the repetitive content |

Goal | Reignite love for local storytelling by recommending hidden gems from India’s indie film scene |

Why would this campaign work ? | Appeals to their taste with emotional resonance Gives them the appeal of diverse Indian content available on the platform |

Pain point |

|

Content/Pitch | Discover India's hidden cinematic brilliance - Only on JioHotstar |

Offer | More than 2 devices if they login through their Jio phone number |

Frequency | 3 times a week |

Timing | Trigger notification if the user has not engaged with the content for more than 2 weeks |

Personalize according to the highly rated hindi content (yet to be watched by the masses) Big Stars not your Thing? Good. Because we have exciting content in store for you! | |

Success Metric |

|

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore foundations by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Crack a new job or a promotion with the ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.